Loading... Please wait...

Loading... Please wait...

- Home

- Strategies for TradeStation

- Swing 500 Trading System for TradeStation

The Swing 500 trading system is a 100% systematic trading system which has been designed and tested on the component stocks of the S&P 500 and includes portfolio level research. The Swing 500 system is a long only trading system designed using daily price data meaning trading signals can be quickly and easily identified in minutes after the market has closed and the system does not require monitoring during the day.

The Swing 500 trading system is not a black box system. All the rules are fully disclosed and explained in detail in a PDF manual along with a set of strategy and indicator files for TradeStation which are open coded. The system has been tested at a portfolio level and includes systematic rules for scanning and selecting which stocks to trade each day, precise order entry and exit points, and managing trades as part of a portfolio.

The Swing 500 system is simple and easy to learn with all the rules fully disclosed and explained in detail. At the core is a swing trading methodology of buying stocks during a pullback and then selling when stocks rebound, but unlike most swing trading methodologies the Swing 500 portfolio trading system is 100% systematic and based upon quantifiable research that was designed and tested on a database of S&P 500 stocks going back to 2005, including delisted stocks.

100% Money Back Guarantee

You can try these indicators and strategies for 30 days risk free and evaluate them for yourself within TradeStation. If after purchasing you decide they are not right for you just let us know within 30 days for a full refund.

Advantages of the Swing 500 trading system.

- 100% systematic - eliminates emotions, discretion and guesswork from your trading.

- Full disclosure of all trading rules - no black box - so you have complete understanding of how and why the Swing 500 system works.

- The ability to backtest and verify the system thanks to a systematic set of rules.

- Strategy indicator provided to scan for trading signals within TradeStation and for use with RadarScreen.

- Know exactly what trades to place each day with precise entry and exit rules.

- Strategy provided as well as indicator and workspace compatible with TradeStation.

- Backed by our 30 day money back guarantee.

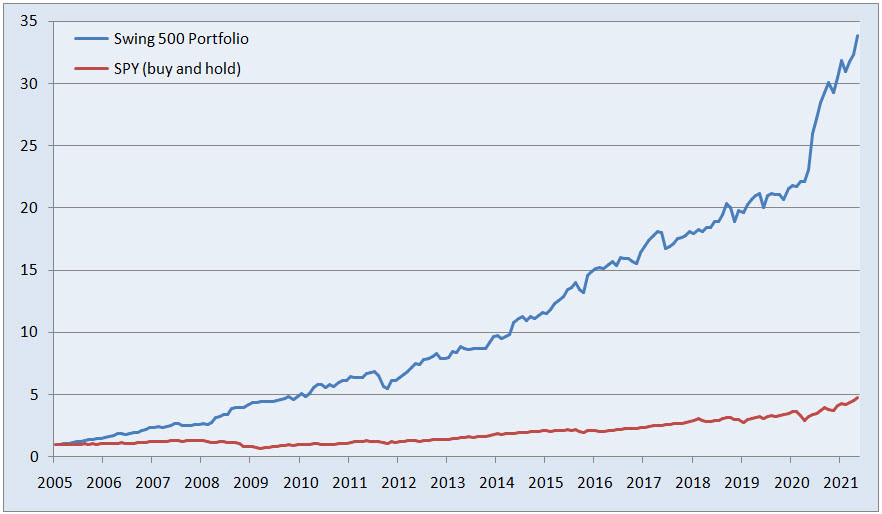

Swing 500 Portfolio Trading System Returns

S&P 500 Stocks 01/01/05 - 04/30/21

The graph below shows the simulated returns of the Swing 500 portfolio trading system applied to the component stocks of the S&P 500 compared to buying and holding SPY over the same period. The returns are based on systematically following the Swing 500 portfolio system rules every day for all stocks tested between January 01 2005 and April 30 2021.

This is not a black box trading system

All the rules of the Swing 500 portfolio trading system are fully disclosed.

As an end of day trading strategy the Swing 500 portfolio trading system does not demand you to sit and monitor the system throughout the trading day. The system only requires that you scan the stock market once a day (either after the market closes or the next morning before the market opens) using TradeStations own scanner or RadarScreen applications so there is no need to spend hours analyzing stock charts looking for the perfect setup. Using the results from TradeStation and our easy to follow step-by-step instructions you can track the Swing 500 trading system yourself each day in minutes.

In addition to the standard version of the Swing 500 trading system we will also provide you with additional information and research on how the Swing 500 system can be applied more aggressively in pursuit of higher returns as well as rules for trading more conservatively with a view to lowering risk and reducing drawdowns.

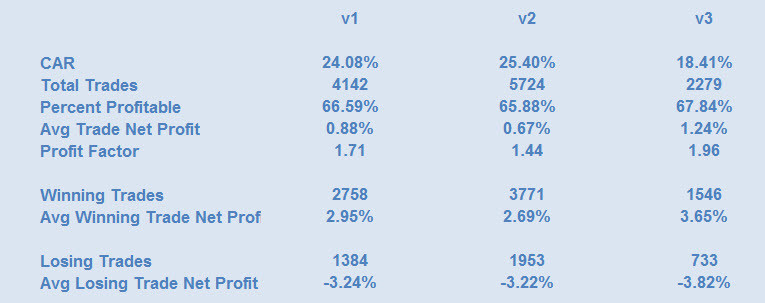

Swing 500 Portfolio Performance Data

S&P 500 Stocks 01/01/05- 04/30/21

Below you can find performance data taken from three portfolios using different versions of the Swing 500 system.

Using a systematic trading system reduces the emotions that can cloud our judgment as nothing has been left to discretion or guesswork. Every aspect of the Swing 500 trading system has been laid out with clear stock selection rules and precise entry and exit points. The trading system also includes portfolio management rules so you know how many orders to place each day.

- 100% systematic - eliminates emotions, discretion and guesswork from your trading.

- Full disclosure of all trading rules - no black box - so you have complete understanding of how and why the Swing 500 system works.

- The ability to backtest and verify the system thanks to a systematic set of rules.

- Strategy indicator provided to scan for trading signals within TradeStation and for use with RadarScreen.

- Know exactly what trades to place each day with precise entry and exit rules.

- Strategy provided as well as indicator and workspace compatible with TradeStation.

- Backed by our 30 day money back guarantee.

While the Swing 500 trading system was developed using the component stocks of the S&P 500 the system can be applied to similarly large-cap stocks not featured in the S&P 500.

The Swing 500 trading system includes a complete set of TradeStation tools (strategy, indicators and workspace) for you to use within TradeStation. The TradeStation files are provided in open code for you to view and includes multiple inputs for you to personalize and optimize the system if you wish.

We have also included a PDF manual which explains the rules and processes associated with the Swing 500 trading system in detail along with a TradeStation compatible strategy file which you can use to help test and validate the rules for yourself.

Additionally a second manual provides additional information and performance data on alternative ways to setup the system should you wish to aggressively trade the portfolio in pursuit of higher returns as well as rules for trading more conservatively with a view to lowering risk and reducing drawdowns.

Strategy for TradeStation

In addition to two PDF manuals explaining the Swing 500 trading system in detail we will also provide you with a strategy file compatible with TradeStation which you can use to help test and validate the system for yourself. The strategy is provided open source so you can view the easylanguage code and see exactly how the strategy works. The strategy include various settings which you can use to adjust and optimize the trading system if you wish. We will also provide you with indicators compatible with TradeStation for use within a chart or RadarScreen or for scanning for signals, and a pre-configured workspace to get you started using the systems.

Delivery

You should expect to receive your order within 1 working day via email.

| 100% Money Back Guarantee These TradeStation compatible add-ons come with a 30 day money back guarantee. During the first 30 days after purchasing these indicators you can use and evaluate these indicators as much as you like. If after purchasing these indicators you decide they are not right for you just let us know within 30 days for a full refund. |

||

Continued Support and Updates for a Minimum of 12 Months

All our products include full support and updates for at least 1 year so if you have any problems or require any additional information you can contact us for assistance.

If you have any questions about this, or any other product we offer, please contact us.

Disclaimer

All information provided is for educational purposes only and it should not be assumed that the information presented will be profitable or that it will not result in losses.

You understand and acknowledge that there is a high degree of risk involved in trading securities and/or currencies. TechnicalTradingIndicators.com assume no responsibility or liability for your trading and investment results and you agree not to hold the company liable for any monetary loss and/or damages of any kind. There is a high degree of risk in trading and you should always consult a qualified advisor about the suitability of any investment.

HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN

Tradestation Disclaimer:

“Neither TradeStation Technologies nor any of its affiliates has reviewed, certified, endorsed, approved, disapproved or recommended, and neither does or will review, certify, endorse, approve, disapprove or recommend, any trading software tool that is designed to be compatible with the TradeStation Open Platform.”

Read our full disclaimer plus terms and conditions here.